"The Role of Technology in Streamlining Your Working Capital Management Process" for Beginners

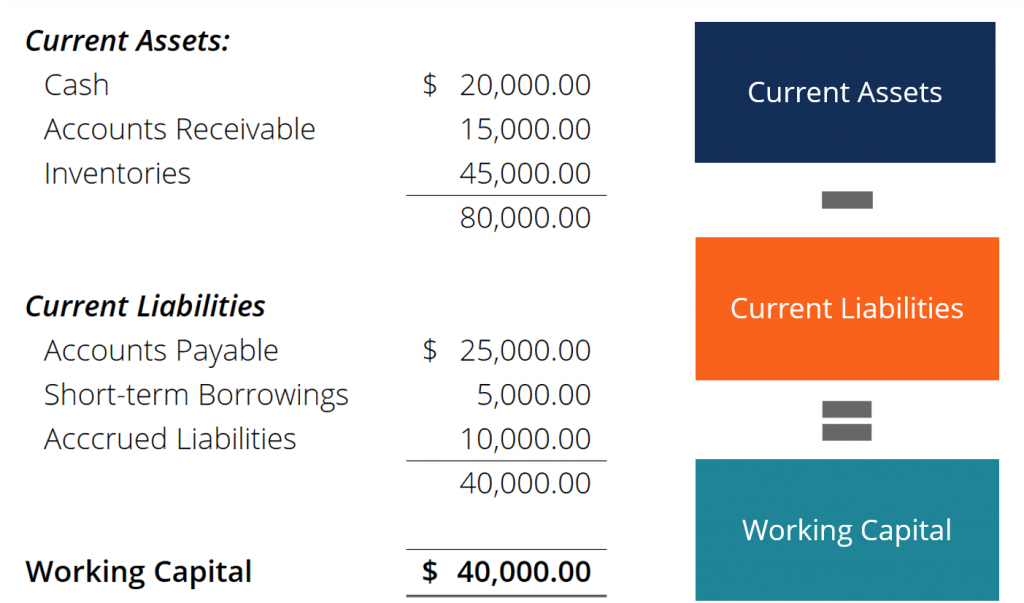

Working resources administration is the method of dealing with a firm's short-term possessions and responsibilities to guarantee that it has sufficient money circulation to satisfy its quick monetary responsibilities. Successful working funds control is vital for any service, no matter of its dimension or industry. Nonetheless, many businesses have a hard time with this part of monetary control, which can lead to significant economic problems. In this post, we will definitely explain some popular risks in working capital administration and how to stay clear of them.

1. Bad forecasting

This Is Cool of the largest mistakes companies make in working resources administration is unsatisfactory foresight. This features inaccurate purchases forecasts, development projections, and stock forecasts. Without exact projections, a company may not have adequate money on palm to meet quick economic responsibilities such as payroll or distributor payments.

To prevent this challenge, services ought to spend in durable forecasting devices that take into account historical information as well as current market fads. In addition, firms need to routinely review their forecasts and adjust them located on real functionality.

2. Overstocking supply

One more usual mistake in working capital management is overstocking stock. While possessing excess supply on hand might seem to be like a really good way to ensure that customers always have get access to to products, it can tie up important cash that might be made use of for other functions such as investing in brand-new tools or marketing initiatives.

To avoid overstocking inventory, providers need to frequently examine their purchases record and change their purchase strategies correctly. Also, businesses should take into consideration executing just-in-time (JIT) supply devices that allow for even more reliable use of information.

3. Overdue settlements

Late settlements are one more common problem that can affect a business's working capital control attempts negatively. When suppliers are paid overdue or invoices are not spent immediately through consumers, it can produce considerable cash money flow complications for a service.

To stay away from overdue settlements, providers must create crystal clear payment phrases along with both providers and customers upfront and communicate these conditions clearly throughout the purchase process. Additionally, organizations might desire to think about executing automated invoicing and remittance units that can easily help enhance the payment method and ensure that payments are helped make on opportunity.

4. Inept accounts receivable monitoring

Inept profiles receivable administration is one more typical mistake in working funding monitoring. When organizations do not have a clear process for invoicing, tracking payments, or complying with up on outstanding accounts, it can easily develop significant cash money circulation problems.

To stay away from this downfall, companies must set up clear methods for invoicing and tracking settlements. This features preparing up automated tips for overdue profiles and having a clear acceleration method in area for consumers who regularly neglect to pay out on time.

5. Inadequate money circulation forecasting

Lastly, unsatisfactory cash money flow projection is another popular problem that can easily influence a firm's working capital management efforts adversely. When organizations do not have an correct understanding of their money flow requirements or do not consider for unanticipated expenses such as devices repair work or legal fees, it may create notable economic complications.

To avoid this mistake, providers need to consistently evaluate their money circulation foresights and change them located on actual efficiency. Also, services should take into consideration implementing emergency plans to prepare for unforeseen expenses or modifications in market problems.

In verdict, effective working financing management is necessary for any sort of organization looking to preserve financial reliability and attain long-term results. Through staying away from these popular pitfalls in working capital control - unsatisfactory projection, overstocking stock, late repayments, unproductive accounts receivable monitoring, and inadequate money circulation foresight - organizations can easily enhance their opportunities of success while minimizing the danger of economic concerns down the collection.